Beyond the Hype: The Hidden Robotics Plays Powering Tomorrow’s Economy

A cross-market analysis of emerging robotics companies and the strategic capital shaping the future of automation

The robotics market is heating up—and not just because of the AI halo effect.

As generative AI and large language models dominate headlines, a quieter but equally transformative revolution is unfolding in robotics. It’s a space that blends hardware, software, and intelligence in ways that go far beyond humanoid robots and drone demonstrations. For investors, this market is becoming increasingly intriguing—not just for the potential returns, but for the complexity and diversity of players shaping its future.

But let’s be clear: robotics isn’t a monolith. It’s a sprawling ecosystem that stretches across industrial automation, logistics, warehousing, defense, agriculture, and even healthcare. From autonomous ground systems and robotic arms to underwater inspection drones and intelligent navigation platforms, the spectrum is vast, and the competitive dynamics are evolving rapidly.

What makes this sector particularly compelling today is the strategic race to build moats around core intelligence including AI-powered instrumentation, data processing, real-time control systems, and sensor fusion. These technical foundations, and not just shiny demos, will determine who dominates the robotics frontier over the next 12 to 36 months.

Over the past several weeks, I’ve fielded a growing number of inquiries from investors and analysts about opportunities in the robotics space across North America, Europe, and Asia. And based on these conversations, I’ve begun a deeper dive into both the marquee names and the under-the-radar players worth watching.

Beyond The Usual Suspects

On the high-profile end, companies like Boston Dynamics, Figure AI, and Agility Robotics continue to capture attention with their ambitious platforms. But equally important are the lesser-known, technically rich companies building utility-driven robotics platforms for real-world deployment. Many of these are already gaining traction in industrial, maritime, and defense markets — sectors that demand resilience, precision, and scalable systems over marketing flair.

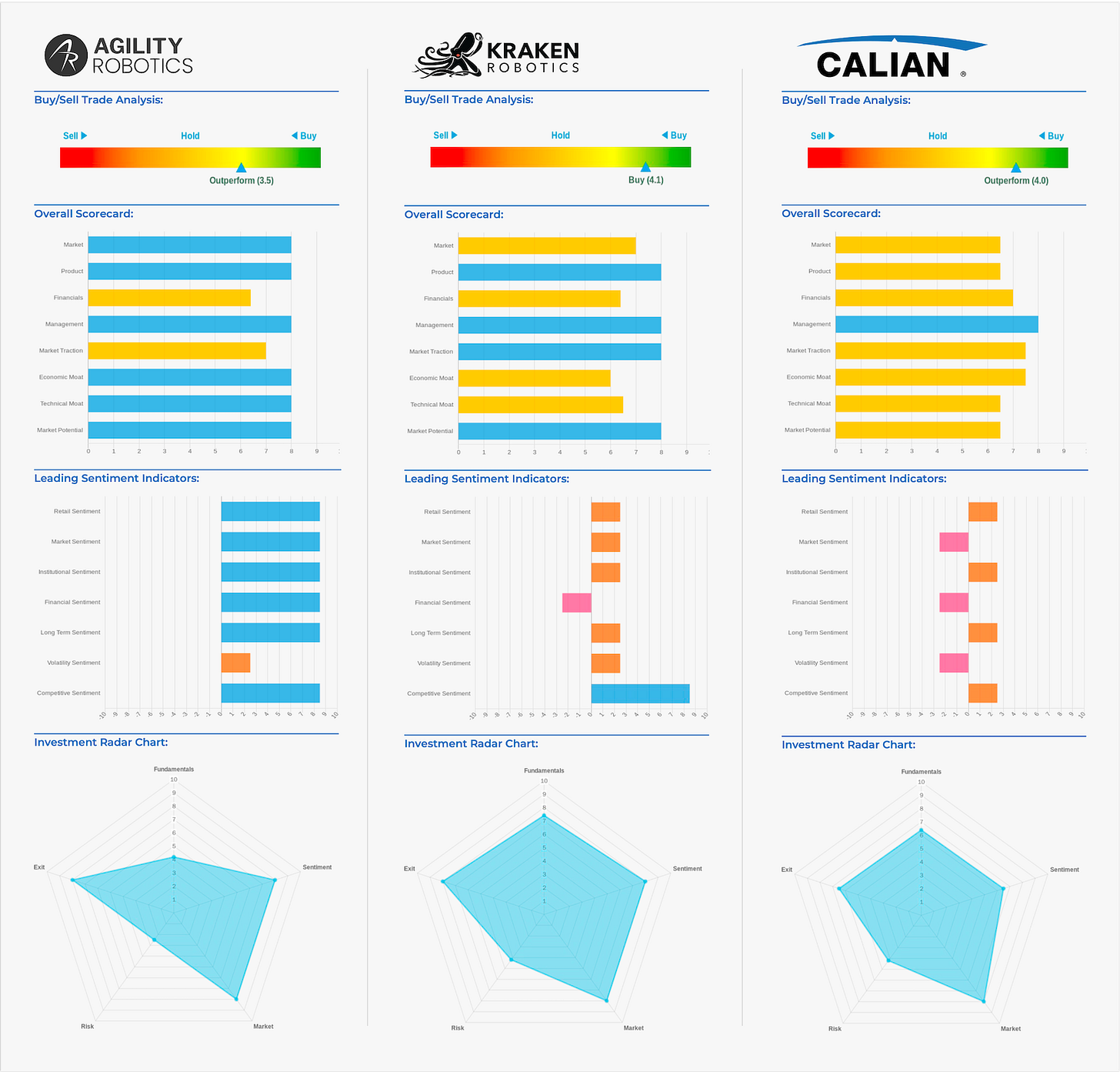

In this piece, I’m taking a closer look at companies with roots in the industrial and defense sectors. Notably, Agility Robotics (fresh off headlines) and Kraken Robotics, a Canadian firm that has also recently made waves with its subsea inspection and defense capabilities. I’ve also included Calian Group, a diversified Canadian player with significant exposure to robotics and defense services. While Calian is less of a pure-play robotics firm — and a bit of an outlier in this grouping — its strategic footprint provides a broader lens into how larger firms are competing in the space.

This isn’t a strict apples-to-apples comparison. Rather, it’s an attempt to map the landscape—to understand how capital, strategy, and risk are distributed across regions and sectors. And in doing so, to uncover potential breakout candidates that may be overlooked amid the noise.

Larger conglomerates—Lockheed Martin, ABB, L3 Harris, and others—are clearly placing strategic bets. And in Canada, we’re seeing similar patterns as firms position themselves to compete on the global stage. However, access to capital remains a real constraint. As seen in the comparison between Kraken and Agility Robotics, sentiment—and investor risk appetite—still skews in favor of U.S.-based firms, even when Canadian players show comparable or superior technical capability.

That said, Kraken’s recent funding round is a strong signal of market confidence, while Calian’s position as a diversified, defense-oriented platform could present meaningful upside as governments ramp up investment in security and automation. As a broader holding, Calian benefits from tailwinds in the robotics space but also faces headwinds tied to macroeconomic pressures and shifting trade dynamics. Still, when it comes to robotics, these aren’t speculative moonshots—they’re grounded, commercially viable opportunities with real momentum.

From Trend to Backbone

Robotics is not a trend—it’s infrastructure. And as the market continues to consolidate, broaden, and bifurcate, there will be plenty of technical plays, geographic differentiators, and adjacent opportunities to consider.

This is just the start of a deeper exploration. In future pieces, I’ll continue profiling emerging robotics companies—particularly those operating in industrial automation and infrastructure sectors where utility, not flash, defines long-term value.

Stay ahead of the market. Uncover hidden signals. Capture the alpha with smarter insights with Charli.